Personalization is the Disruption that Some Insurance Companies may not Survive

It’s the end of the year, an opportunity for many to look back on the year’s achievements and look ahead to the promise of a new year. It is also a time of reckoning. And when it comes to the insurance industry, it’s time to acknowledge that personalization is the meteor that may cause the mass extinction event of some insurance dinosaurs. (Insurance companies shouldn’t feel singled out; personalization has taken over many other industries that had resisted innovation for years).

The Market is There

Surveys have shown that insurance customers overwhelmingly say they are looking for personalized offers/ pricing/ recommendations and that they are willing to provide usage and behavior data in exchange for lower premiums and quicker settlements. It is not surprising, given that consumers today can get their shoes, cellphones and even cars personalized.

Applying a more personal approach, can enable insurers to:

- Adapt their offers to their customers’ needs.

- Communicate via messages that customers find relevant and based on previous interactions with them.

- Offer pricing that dynamically considers customers’ behaviors, usage and the loss-prevention measures that were taken.

The Revenue is There

Insurers are being encouraged by industry analysts to migrate from a transactional mentality to a relationship mentality. This makes complete financial sense since personalized marketing in other industries has produced a decrease in acquisition costs by as much as 50 percent and stimulated a growth in revenues and customer satisfaction by 5 to 10 percent. In a $30Bn industry (US and Europe), even a 5% increase in customer retention translates into a lot of performance bonuses.

The Competition is There

Insur-tech disruptors such as Lemonade have recognized the consumer demand for a more personal approach. This allows them to create more appealing, specialized products and offer them only to specific segments of consumers, so they can generate revenues without taking on more risk. Even non-insurance companies like Google and Walmart have started to leverage the volumes of data that they have on their consumers to offer them policies that are both competitively priced and also profitable.

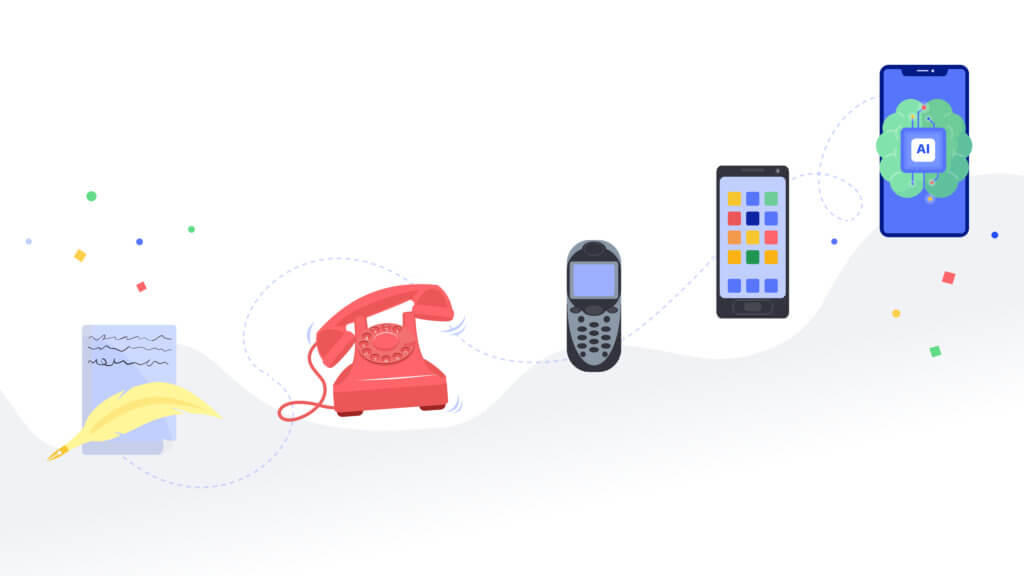

The Technology is there

AI found its way into analysis and decision making a while ago, but now it is being used to provide faster service, identify fraud and put a value on different behaviors that lower risk and increase profitability. It’s not just about allowing them to file a claim on their mobile. Introducing AI on their mobile phones helps insurers become a useful, helpful presence in their daily lives, proactively making suggestions for better health and wellbeing as well as home care, car safety and disaster prevention. Perhaps even more importantly, this technology (called Edge AI) also finally enables personalization without compromising consumer privacy, since all the analysis and the data remain on the device. This helps introduce a new level of trust to the relationship and protects the insurer from the exposure of handling any additional sensitive data.

Personalization is about creating a win-win between companies and consumers. Given the overall reputation of insurance companies and the way they are perceived by their customers, this is a win that they need to take. While the hits to their market-share may have been manageable in 2020, there is no reason to think that in a post-COVID 2021, with consumers across the world facing extreme changes in their financial circumstances, the trend towards personalization will not continue. That meteor is already on its way.